With the aim to launch one new vaccine each year, Serum Institute aims at entering European Market.

Pune: Serum Institute, based in Pune aims at launching a new vaccine each year and is set to bring out the first ever synthetic vaccines for rabies by year-end.

The Poonawalla Group is investing 1500 to 2000 crore rupees in clinical trials for vaccines in the pipeline and a new SEZ Facility in Pune. Out of the invested amount, half has already been put to use, according to the CEO of the Group, Adar Poonawalla.

"Serum till now has not been able to penetrate the European market even though we export to 140 countries, as they hold extremely high standards and stringent regulations which require you to invest more and increase your standards." said Adar Poonawalla.

The new facility by Serum, aims at raising the current capacity of 1.2 billion by more 500 million doses over five years of time, and is being backed by the profits of the Group.

Poonawalla further explained the agenda for th next five years, " The synthetic vaccine for rabies which is a monoclonal antibody was scheduled to come into the market by the end of 2016 or in early 2017. It is the first ever synthetic vaccine and just one or two doses of the vaccine would suffice for the neutralisation of the disease. Also, unlike equine antibodies, this vaccine would not give reactions." This vaccine is set to be launched by Serum in the first or second quarter of 2017.

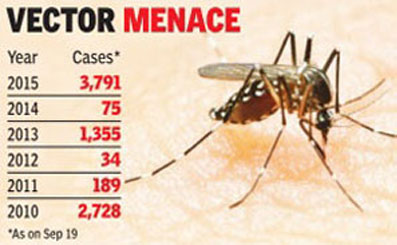

The vaccines in the pipeline include the ones for cervical cancer and dengue. 2018-19 would see a vaccine for pneumonia which would be the first entirely in-house developed vaccine by Serum.

Adult vaccines

Poonawalla expressed his views on the Indian vaccine market. Serum's portfolio hosts three-in-one flu, H1N1 and rubella. However, these vaccines have failed to take off. This could be because of the apathy among the masses.

Poonawalla said, "We deal with a general indifference. People would rather spend on technology than on healthcare."

Paediatric vaccines do well on the other hand. Poonawalla further added, "Only mothers are committed to get their children immunised. They are willing to go to extreme lengths to ensure that. That is why making a dengue vaccine won't receive the same response from the market."

At this juncture, from 4000 crore rupees of revenue sees 85% of it coming from overseas. Poonawalla hope for that to change to 60% over upcoming couple of years with the help of Centre's immunisation programmes.

IPO ruled out

Putting a firm foot down on the IPO Saga, Poonawalla explained, "In order to give a potential equity investor an exit, we were ready to list. It was the only reason for us to be prepared to list. We were hoping for the money to embrace more cities for clean initiatives. We don't need the money for business, and the valuations weren't high enough. That is why we closed the chapter."

He further expressed his disappointment by saying, "I was saddened by the funds and bankers who are interested only in funding those institutions who rob banks or shareholders or IT Companies. These institutions have never earned any profit and still people did not back a company with a solid 40-year old foundation and no debt.This however, was a lesson for me and I am happy to have closed the chapter."