How Cyrus Poonawalla's son, Adar Poonawalla is boldly changing course of the family business

Ensconced in Serum Institute of India's baroque boardroom, gazing down upon the greens of the Poonawalla Stud Farms, it's easy enough to forget that the company makes vaccines for scary diseases like rabies, tetanus and measles right next door. But then again, that's the Poonawallas for you. The family has built a Rs 4,000 crore privately owned company that is set to become the world's largest manufacturer of vaccines - but their race horses, sports cars, private jets and Sharon Stone charity events are so very distracting.

That's also why it is easy to dismiss Adar Poonawalla as a rich brat. He certainly looks the part, posing next to race horses in a photograph specially commissioned from celebrity lensman Atul Kasbekar. But the flamboyance is cultivated and the 33 year old heir is quite a serious young man who has been trained by a difficult boss - his father Cyrus Poonawala. Five years ago, the Senior Poonawalla was quoted saying he saw no point in stretching the organisaton's resources "unless my son is capable of running the companies." Today, junior seems to have made the grade and come into his own.

Adar's new calling card says it all: from executive director, operations, he has now been designated CEO. "But my father is still the chairman and he's really headstrong. He does what he likes and undoes my decisions," he says.

Educated from the age of ten at St Edmund's School, Canterbury, Adar did his bachelors from the University of Westminster. While in London, he took a few courses in biotechnology and management, but higher education was not his cup of tea. He happily returned home to Pune at the age of 21. "Who really enjoys going to school?" he says. "My father had made it with a bachelor degree and he thought I would be better off joining the business."

He may grumble about his dad vetoing his decisions, but father and son obviously have a close relationship. Adar moved out of the family mansion soon after getting married but he's moved back after his mother passed away a few years ago. In the 12 years he's been working under his father, he's imbibed much of the Senior Poonawalla's management style. That includes a propensity to micro-manage.

"We're involved in everything, nothing is too small for us to look into," says Adar, with the candor the Parsis are famous for.

"As a family run company, our decision making is centralized. There's less empowerment, so it's a challenge recruiting senior management from outside. They fail to perform, fight with us and resign."

A PhD in microbiology, executive director Rajev Dhere has been with Serum Institute for 28 years and has worked closely with both father and son. He says: "Other companies have systems, whereas this company is individual driven. But we do need to put some systems in place now, especially in the area of human resource management."

The Serum Institute is a 24x7 operation employing 4,000 people and there's a limit to the attention the family can pay to detail. In the absence of proper control systems, this has sometimes created tricky situations.

One of Adar's major initiatives - one he's particularly proud of - has been taking action against those found to be involved in shady practices. He's dismissed more than 50 people, including the marketing head.

"Everyone knew what these people were up to, so getting rid of them has actually boosted morale. My father would shout at them during meetings but he never had the heart to take disciplinary action. He was soft in these matters; he didn't want to lose people. The action I've taken has got me respect from my father," says Adar.

Another initiative that is Adar's very own is the launch of Serum Institute's oral polio vaccine. In 2012, the World Health Organisation (WHO) and UNICEF sent the company an urgent request to help bridge the anticipated demand-supply gap in this vaccine category, saying any shortfall might set the global polio eradication back by several years. The profit margins on the product were negligible but the effort called for was huge since production needed to start in six months. "My father was very skeptical about the project. He felt we shouldn't get involved. But I was persistent. I felt it would fit with the injectable polio vaccine we already made in our unit in The Netherlands," says Adar.

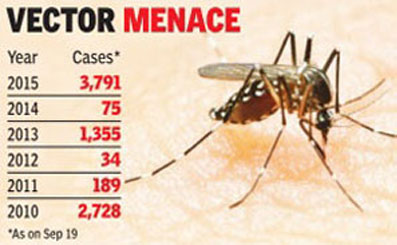

Using bulk drugs imported from Indonesia, Serum Institute started production of the oral polio vaccine in Pune in 2013 and the product has been a bestseller. The company's mainstay has always been traditional vaccines for measles and rabies, which it exports to 140 countries through WHO and UNICEF. While developed countries no longer need these products, demand for emerging nations of Asia and Africa has been growing rapidly. Now Adar plans to expand the company's product portfolio further, to new age vaccines for dengue, flu and cervical cancer.

Earlier this month, he was in Paris to talk to a French scientist who is working on a HIV vaccine. "In this industry, decisions are taken on limited information and bad forecasting.

But over time, we've created surplus capacities that are already double the global demand for vaccines. We are already set to become the world's biggest vaccine maker, by volumes."

While the Junior Poonawalla is amenable to taking more risks than the Senior, there's one principle he still determined to adhere to - the company will not borrow or go public and growth will only be through internal accruals. "When you're spending other people's money, you do a whole lot of things that often go wrong. When it's your own money, you have to think things through. Your strategy is limited but clear," he says.

Then there are those corporate jets and helicopters the company keeps buying. The senior Poonawalla has said he doesn't want to be confronted with the governance issues that automatically come with using public money to buy these things. Adar wholly agrees, and adds: "That we run our company in a grand way helps our business. It makes an impression on the foreigners who come for inspection. Our manufacturing facilities are the best in the world. Everything we do is world class."

Despite the occasional extravagance, the company actually has one of the lowest overheads in the industry. Combined with zero debt, this allows it to quote the lowest prices in its tenders to WHO and UNCIEF and still earn a profit. With nearly 50 years of experience in vaccine manufacture, the company is a master in its field. "We have a knack for scaling up and process improvement," says Dhere. "The scientists working in our research and development laboratory have been very successful in increasing output without any increases in fixed costs. Our large volumes also help us procure raw materials at the best prices."

Serum Institute has operated on volumes, which party explains why it never entered into the manufacture of vaccines for different kinds of flu, including swine flu and bird flu. The belief then was that there would not be enough demand, since flu doesn't actually kill anybody, and the company would have to stockpile the product in anticipation of a pandemic. Now, with encouragement from the Bill Gates Foundation, Serum Institute has moved into flu vaccines in a major way. "Many of our new vaccines are stuck at the clinical trials stage," complains Adar. "Today, it's faster to do a clinical trial in Europe than in India."

In the past, the Poonawallas have invested their surpluses in buying up stakes in other bio-tech companies like Orchid Pharma and Panacea Biotech. While they are holding on to a few strategic investments, the Poonawallas have now decided to move money out of stock market and invest instead in things they can enjoy - like European art. The Poonawallas collection now includes paintings by Renoir, Monet, Van Gogh and Picasso, all bought at Christie's and Sotheby's auctions. Adar keeps these at his house in Mumbai, where he normally spends his weekends.

"I'm told there's a law that says I can't take these paintings out of the country, which doesn't make sense. But they're great investments. Chinese buyers are driving up prices like crazy." And what about Indian art? The answer is, once again, Parsi plain speak: "Indian art doesn't appeal to me. I don't understand those abstract paintings with a big circle in a square. I wouldn't buy them."

Source: The Economic Times